UK Non GamStop Casino Options and Safety Tips

UK Non GamStop Casino Options with Practical Safety Advice for UK Players

Prioritize platforms licensed by Malta Gaming Authority (MGA), Curacao eGaming or the Gibraltar Betting Commissioner; confirm the licence number on the regulator’s public database before funding any account. Require independent audits from iTech Labs, GLI or eCOGRA with documented sample return-to-player (RTP) rates above 95%, plus transparent payout reports for the most-played titles.

Ultimate UK Non-GamStop Casino Guide (August 2025)

1

Up to €3000 + 375 Free Spins

2

100% + 100FS in Big Bass Bonanza

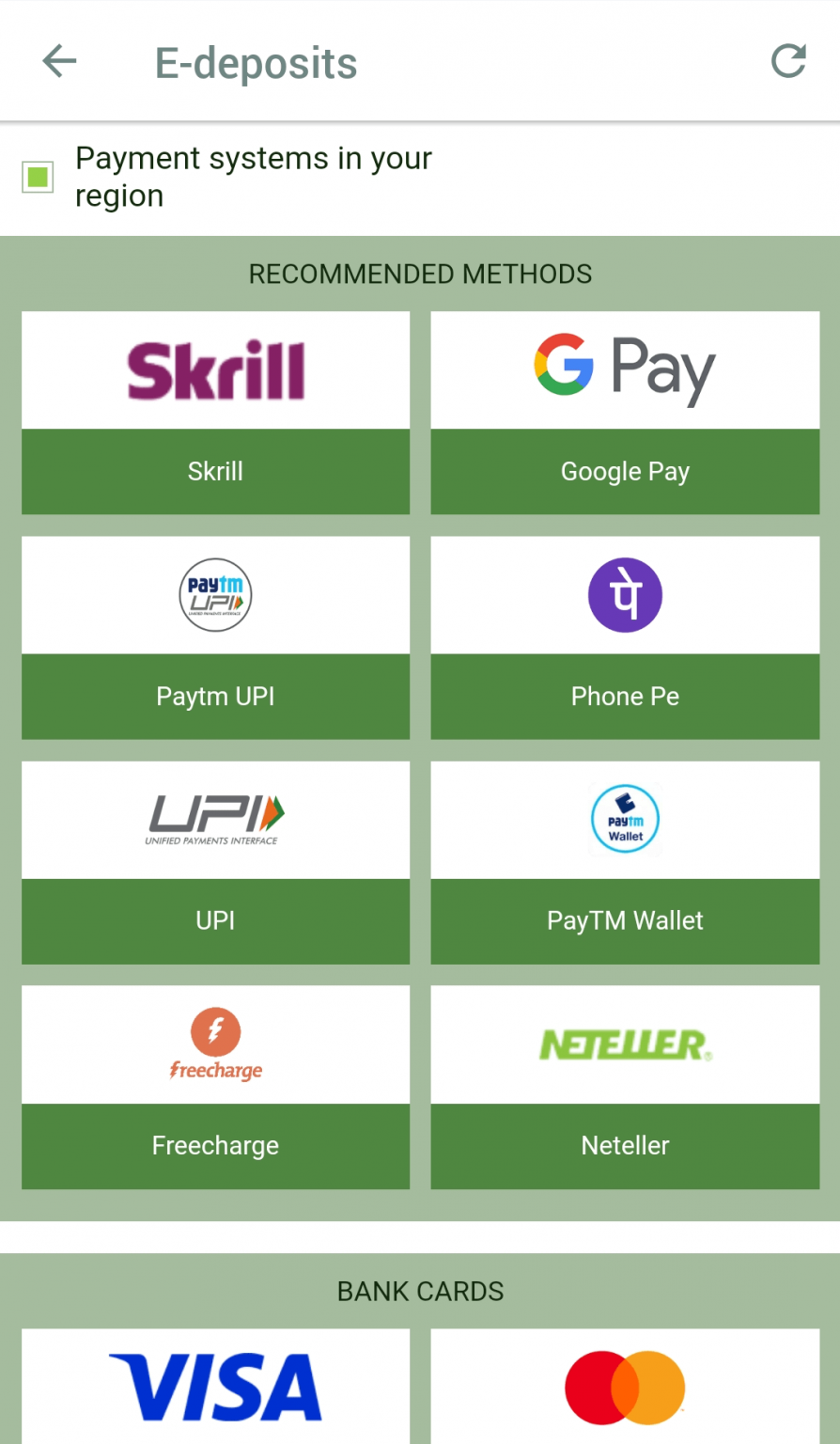

Prefer e-wallets such as Skrill or Neteller, prepaid vouchers like Paysafecard or cryptocurrencies (BTC, ETH) for faster withdrawals and reduced card exposure; plan on e-wallet clears within 24–72 hours, bank transfers within 2–5 business days. Verify HTTPS/TLS 1.2+ connection, site-wide 256-bit encryption, mandatory KYC thresholds, optional two-factor authentication; avoid platforms that impose ambiguous wagering requirements or undisclosed processing fees.

Reduce exposure by setting firm deposit limits, session-duration caps and maximum stake rules; keep single-session risk below 1–2% of disposable bankroll, limit monthly deposits to a fixed percentage of net income. Install third-party blocking tools such as Gamban or BetBlocker, request operator-level exclusion periods, retain written records of account closures and withdrawal disputes for escalation to the regulator.

For dispute escalation use the regulator’s formal complaints portal; when a regulator lacks binding arbitration, initiate a card issuer chargeback within 60–120 days depending on bank policy. For wellbeing support contact BeGambleAware or GamCare, access telephone or web counselling, seek independent financial advice if losses threaten household stability.

How to confirm an offshore gaming site’s licensing and regulator status

Verify the licence number shown in the site’s footer or “About” page by checking it against the issuing regulator’s public register before depositing funds.

Locate the exact licence string and issuing authority. Common issuers for UK-facing operations include the UK Gambling Commission (UKGC), Malta Gaming Authority (MGA), Isle of Man Gambling Supervision Commission, Gibraltar Regulatory Authority and Curacao eGaming. Example formats: “MGA/B2C/248/2013”, “UKGC 000-XXXX-R-XXXX”. Copy the whole string – partial matches are useless.

Use the regulator’s official verification tool or public register on its website to search the licence number. If the entry does not appear, send the licence number to the regulator’s compliance email and request confirmation. Regulators will confirm whether a licence is active, suspended or revoked.

Compare operator details: confirm the licence holder’s legal company name, registered address and company number shown by the regulator match the site’s corporate disclosures and any Companies House entry (for UK companies). Mismatches between the site brand and the registered operator are a red flag.

Validate the licence certificate: download any PDF certificate offered on the site and verify serial numbers, issue/expiry dates and digital signatures against the regulator record. Beware of certificates shown only as images or screenshots – these cannot be authenticated.

Check licence scope and permissions: ensure the licence type covers remote/online activity and the products offered (slots, live dealer, sports betting). Some licences are limited or sublicences (common with Curacao) – sublicence arrangements reduce regulatory oversight and should lower your trust level.

Cross-check third-party signals: reputable payment processors, software providers and independent complaint platforms (e.g., AskGamblers, Casinomeister) will list legitimate operators. Verify that claimed providers actually list the operator on their client pages; absence or denials are a warning.

Search regulator enforcement logs for sanctions or investigations tied to the licence number. If you find historic fines, warnings or restrictions, treat the licence as compromised until you confirm remedial action directly with the regulator.

If uncertainty remains after these checks, refrain from deposits, request written confirmation from the regulator, document all correspondence and consult your bank about reversible payment methods or chargeback procedures.

Verifying site security: SSL, privacy policy, data handling

Immediately confirm TLS 1.2 or TLS 1.3 in use; click the browser padlock, view certificate issuer, verify expiry date at least 30 days ahead.

Run an external SSL scan (Qualys SSL Labs recommended); require grade A or A+. Check for ECDHE key exchange, AES-GCM ciphers, RSA key size ≥2048 bits or ECDSA curve P-256, certificate signature SHA-256 or stronger. Reject sites serving TLS 1.0, TLS 1.1, RC4 ciphers, or that present self-signed certificates.

Inspect HTTP headers for HSTS presence, Content-Security-Policy rules, X-Frame-Options, Referrer-Policy; verify cookies include Secure, HttpOnly, SameSite=strict or lax as appropriate. Test for mixed content issues by loading the page with developer tools; any blocked insecure requests are a red flag.

Open the published privacy policy; require explicit lists for: categories of personal data collected, legal basis for processing (consent, contract, legitimate interests), specific retention periods for each category (example: transaction records retained for six years to satisfy HMRC obligations), names of third-party processors, international data transfer safeguards (SCCs, adequacy decisions), DPO contact details, user rights under UK GDPR with clear exercise procedure.

Assess storage and account protections: passwords hashed with modern algorithms (Argon2id preferred; bcrypt acceptable with work factor ≥12), unique per-user salts, encryption at rest for sensitive fields, tokenization for card data, explicit statement of PCI DSS v4.0 compliance for payment handling. Look for 2FA options using TOTP or hardware keys; treat SMS-only 2FA as weak.

Require independent evidence: ISO 27001 certification, recent penetration-test summary, public bug bounty program or third-party audit reports. Verify breach notification policy states 72-hour notification window to regulators where required; confirm backup frequency, access controls, least-privilege role separation, audit logging.

Immediate red flags: missing HTTPS, expired certificate, vague or absent privacy policy, no contact or address details, SSL Labs grade below B, presence of clear-text API endpoints, refusal to name payment processor, claims of unlimited data retention without explanation. If any red flag appears, avoid account registration until issues are resolved.

Quick checklist: click padlock → confirm TLS 1.2/1.3; run SSL Labs → grade A/A+; view headers → HSTS+CSP present; read privacy policy → retention periods, processors, DPO listed; verify password storage statement → Argon2id/bcrypt; confirm PCI DSS v4.0 for payments; search for ISO 27001 or audit reports; check domain age via WHOIS; run haveibeenpwned lookup for breached accounts.

Payment methods for UK players: cards, e-wallets, bank transfers, crypto

Use an e-wallet for fastest cashouts; keep a verified bank account for high-value transfers; use cards for instant deposits when chargeback access is required; use crypto for low-fee cross-border movement, keeping volatility in mind.

Cards: Visa, Mastercard, prepaid VISA/MC. Deposits almost instant. Withdrawals usually 1–5 business days, depending on issuer. Expect currency conversion fees 0.5%–3%, plus potential fixed fees. 3D Secure and Strong Customer Authentication (SCA) apply for UK/EU-issued cards; keep AVS, 3DS active. Chargeback routes exist through card issuer within specified timeframes, document all transactions for disputes. Some providers block gambling-related merchant codes; have a backup method.

E-wallets: PayPal, Skrill, Neteller, ecoPayz. Deposits instant, withdrawals often same day or within 24 hours. Fees vary: deposit 0%–3%, withdrawal flat fee or percentage, currency conversion fees apply. High daily limits common once KYC completed. Faster dispute resolution than on-chain crypto, with buyer protection depending on provider policy. Use e-wallets to separate bank/card records from merchant transactions.

Bank transfers: Faster Payments for GBP (near-instant), CHAPS for large same-day transfers (higher fees), BACS for payroll-style processing (3 business days). Withdrawals to UK banks commonly 1–3 business days; international SWIFT takes several days plus correspondent fees. Minimal per-transaction fees for domestic moves, higher costs for CHAPS and SWIFT. Low reversal possibilities once settled; ensure beneficiary details match KYC records.

Crypto: Bitcoin, Ethereum, USDT (ERC-20, TRC-20), BSC tokens. Deposits process after required confirmations, typically 10–60 minutes for common setups; withdrawal time depends on network congestion. Fees are network-dependent, ranging from cents for stablecoin on fast chains to several dollars for busy ERC-20 transfers. No chargebacks; on-chain transfers are irreversible. Use reputable custodial exchanges for fiat conversion, move holdings to hardware wallets for storage, prefer stablecoins to avoid GBP volatility during big transfers.

Prepaid and virtual cards: Paysafecard, Revolut disposable cards, virtual cards from Monzo. Good for strict bankroll control, deposits only in most cases. Withdrawals usually impossible to the same voucher; plan a withdrawal route beforehand using bank transfer or e-wallet.

| Method |

Typical providers |

Deposit speed |

Withdrawal speed |

Fees |

Recovery options |

Best use case |

| Cards |

Visa, Mastercard, prepaid cards |

Instant |

1–5 business days |

0%–3% FX, occasional fixed fees |

Chargeback via issuer |

Quick deposits, dispute capability |

| E-wallets |

PayPal, Skrill, Neteller, ecoPayz |

Instant |

Within 24 hours |

Variable: flat fees, percentages, FX charges |

Provider dispute processes |

Fast withdrawals, privacy from bank statements |

| Bank transfers |

Faster Payments, CHAPS, SWIFT |

Instant to same-day |

1–3 business days (domestic) |

Low domestic fees, higher CHAPS/SWIFT fees |

Limited reversals after settlement |

High-value moves, direct GBP settlement |

| Crypto |

BTC, ETH, USDT, BSC tokens |

Minutes to hours per confirmations |

Minutes to hours, network-dependent |

Network gas fees, exchange conversion fees |

Irreversible on-chain, recover through exchange only if custodial |

Low-cost cross-border transfers, privacy, fast settlement |

KYC and ID checks: what to expect at UK platforms outside the national self-exclusion scheme

Verify identity before requesting any withdrawal: upload a passport or photo driving licence plus a proof of address dated within the last 3 months to prevent payout holds and account freezes.

Accepted documents and how to present them

Primary ID: passport, photographic driving licence, national ID card. Proof of address: utility bill, bank statement, council tax or tenancy agreement dated within 90 days. Proof of funding for card or e‑wallet payouts: bank statement showing the relevant transaction, or e‑wallet screenshot with account email. File types normally accepted: JPG, PNG, PDF; typical size limits 2–10 MB (5 MB is common). Submit colour scans or photos with all four corners visible, no glare, all text legible. For cards show first six and last four digits; conceal middle digits. If a selfie is requested, hold the ID next to your face and a handwritten note with the current date and the platform name; ensure face and document details are clear.

Processing times, triggers and practical steps to speed verification

Automated ID checks using providers such as Onfido, Jumio, Veriff or Experian can return results instantly. Manual reviews typically take 24–72 hours; complex cases or large withdrawals can take up to 5 business days. Common triggers for extended reviews: withdrawal requests over £1,000, mismatched names or addresses, multiple accounts, rapid deposit/withdrawal activity, use of VPNs, or use of payment methods not matching account name. To reduce delays, prepare full-colour scans, upload all requested documents in a single submission, ensure billing address matches ID, and use the same payment method for deposits and withdrawals where possible.

Check the platform’s licence: UK Gambling Commission licence means checks follow UK anti-money‑laundering rules and GDPR-level data handling. Licences from Malta, Isle of Man or Gibraltar also typically provide robust protections; Curacao-licensed platforms may keep longer retention periods and offer weaker consumer remedies. Use only HTTPS upload portals; avoid sending ID to an unverified email address. If verification is delayed, open a support ticket, quote any reference number, and attach the same documents again via the secure upload form rather than by email.

Managing deposits, losses when UK self-exclusion scheme is unavailable

Immediately contact your bank to block merchant-category codes linked to gambling, request a permanent block on such merchants for all debit cards, ask for a replacement card with a new number; enable instant transaction alerts for any merchant classified under gambling categories.

Set strict funding caps: limit daily, weekly, monthly debit-card loads to concrete amounts such as £10 daily, £50 weekly, £150 monthly; create an automated sweep that moves surplus funds into a separate savings account with no card access.

Remove stored payment details on every platform account, cancel recurring deposits set via direct debit, submit written account-closure or data-deletion requests to operators; archive confirmation emails and screenshots to support any later disputes.

Use closed-loop payment products only when unavoidable: single-use vouchers, load-only prepaid cards, limited-value e-vouchers that cap exposure; avoid credit facilities, overdrafts, instant bank-transfer services that raise loss potential.

Install blocking software such as Gamban or BetBlocker across desktop and mobile devices; apply browser extensions that block gambling sites, deploy DNS-level filters like Pi-hole with curated blocklists to reduce accidental access.

Track losses precisely: export bank statements, tag every gambling-related entry, compute weekly loss rate; convert that figure into a repayment plan with fixed, time-bound contributions, for example 25% of disposable weekly income until losses drop below a predefined threshold.

Pursue recovery routes promptly: request a chargeback from the card issuer within the typical 120-day window if transactions were unauthorized or misrepresented; if declined, file a complaint with the Financial Ombudsman Service, seek Citizens Advice support for paperwork and escalation.

Add social controls: give physical cards to a trusted contact for temporary custody, set app PINs known only to that person, disable biometric payments; appoint a third-party authority at your bank for spending oversight where that facility exists.

Access specialist help: contact GamCare on 0808 8020 133 for UK-specific support, use NHS local services via GP referral for mental-health assessment, join peer-support groups for accountability; record dates, times, case numbers of every contact for future reference.

If any future use of wagering platforms is considered, implement a staged reintroduction with binding deposit limits, extended deposit-free intervals, external monitoring by a support person; otherwise maintain permanent blocks and automated controls until financial stability is restored.

Choosing fair games: reading RNG certificates, audit reports

Verify RNG certificate issuer, certificate number, issue date.

Preferred test labs: GLI; iTech Labs; eCOGRA; BMM Testlabs; QUINEL. Confirm ISO/IEC 17025 accreditation or equivalent. Download original PDF from the platform; cross-check certificate ID on the lab’s official domain.

Key certificate fields to inspect: issuer name; certificate ID; issue date; expiry date; scope of testing – RNG algorithm, payout verification, platform coverage. RNG type should be specified: Mersenne Twister, AES-based CSPRNG, Fortuna, or hardware random source. Sample-size figures: for slot-style titles expect ≥10,000,000 spins; for table games expect millions of hands. Seed-source description must be present.

Statistical tests commonly used: frequency/chi-square; runs test; serial correlation; Kolmogorov–Smirnov; spectral analysis; entropy estimate; Monte Carlo variance. Reports that publish p-values, confidence intervals, pass/fail thresholds offer stronger evidence.

Audit report elements to prefer: methodology section with test duration; raw logs or sampled outputs; clear statement whether testing was black-box or included full source-code review; re-seeding policy; seed entropy source; RNG state persistence across sessions; paytable verification; jackpot-seed handling.

Validation steps: open the linked certificate PDF; ensure operator name on certificate matches the platform; search the issuing lab’s certificate database for the ID; verify digital signature or SHA-256 hash when provided; check issue date within the past 12 months; if older request a fresh audit or ongoing monitoring feed.

Red flags: missing lab name; image-only certificate without metadata; certificate ID absent from the lab’s site; stated sample size <1,000,000; statistical tests not listed; scope limited to paytable checks only; expired certificate; lab without ISO/IEC 17025 accreditation; claims of a "proprietary audit" without raw results.

When unsure request the full audit report via support; ask for test logs, RNG-algorithm description, sample hashes. Compare reported RTP figures with session averages from independent tracking tools to confirm consistency.

Spotting scam indicators: delayed payments, fake reviews, cloned sites

Require written payout terms before depositing: confirm displayed withdrawal timeframes, maximum pending period, fee schedule, required verification steps.

Payment delays: benchmarks, red flags

Legitimate payout benchmarks: e-wallets 24–72 hours, card withdrawals 3–7 business days, bank transfers 3–10 business days. KYC checks typically resolve within 48–72 hours; repeated requests for the same document without progress signal a problem. Treat delays exceeding 14 days as high risk; delays over 30 days with no firm timeline usually indicate fraud. Red flags include sudden ‘processing’ fees requested before payout, partial payments without confirmation, mismatching transaction IDs in account history, support replies that only promise ‘soon’ with no timestamps.

Protective steps: perform a small withdrawal test before staking large sums, choose payment methods that allow chargebacks such as debit/credit cards, prefer e-wallets for faster settlement. Save screenshots of account balance, withdrawal requests, support chats, email receipts. If a withdrawal remains unpaid after 14 days, contact the payment provider immediately to open a dispute; if the payment provider declines, prepare a chargeback claim within your card issuer’s window (typically 120 days for many issuers).

Fake reviews: detection methods

Signs of manufactured feedback: multiple five-star posts with near-identical wording, reviewer profiles created the same day as the first review, reviews that only praise payouts with no operational complaints, reviews hosted solely on affiliated pages. Verify reviews by searching for exact phrases in quotes across the web, inspecting reviewer histories on platforms like Trustpilot, running reverse-image searches on reviewer avatars, checking timestamps for clusters within hours or days. Give more weight to complaints about withdrawals than to general praise about bonuses.

Cloned-site checks: compare a claimed licence number with the regulator’s public register, paste the licence into the regulator search box to confirm holder name, issue date, scope. Inspect WHOIS for domain creation date; a domain younger than three months increases risk. Click the SSL padlock to view certificate issuer, registered domain; mismatched common names, self-signed certificates are red flags. Watch for typosquatting in URLs, unusual subdomains, contact emails using free providers instead of a corporate domain. Test payment forms in browser developer tools to see the payment endpoint; external merchant IDs that don’t match the claimed operator suggest a clone.

Evidence collection and reporting: archive page copies via web.archive.org, save full-page screenshots with timestamps, export transaction logs as PDF. Report suspected fraud to your payment provider immediately, file a report with Action Fraud in the UK, lodge a complaint with the regulator if the site claims a licence it cannot prove. Notify the domain registrar through an abuse contact if cloning is evident, submit suspicious URLs to browser blocklists where possible.

Bonuses and wagering terms: clauses to watch before you accept

Always verify whether the playthrough applies to the bonus only or to bonus+deposit, then calculate the exact turnover required before agreeing.

Quick decision checklist:

- Is wagering applied to bonus-only or bonus+deposit?

- Multiplier ≤20x on bonus-only or ≤15x on combined funds? (prefer lower)

- Are slots weighted 100% and table/live games low or zero?

- Is max bet during wagering acceptable (e.g., ≥£5 if you plan bigger bets)?

- Is the time window sufficient to meet turnover?

- Are there payment-method exclusions or low cashout caps?

Red flags to reject the offer: wagering >50x, 0% contribution for all slots, max-bet very low relative to your stake, spin-win cashout ≤£20 on big spin packages, or vague terms that refuse to specify whether deposit is included. If any point is unclear, request written confirmation from support and save the reply before accepting.

Dispute resolution: steps for chargebacks, reporting offshore operators

Contact your card issuer’s fraud team immediately, request provisional credit while a chargeback is lodged, supply transaction ID, merchant name, date, settled amount.

-

Lodge a written complaint with the operator within 48 hours, use email only, save sent copy, request written acknowledgement with a 14-day response deadline.

-

Assemble an evidence packet for the payment provider:

- Transaction IDs, full timestamps, currency involved, settled amounts

- Bank statements showing the specific entries, merchant descriptor

- Screenshots of account balance, withdrawal requests, error messages

- All chat transcripts, emails, support ticket numbers, names of representatives

- URL snapshots, promotional messages, terms that contradict operator responses

- If crypto used, wallet addresses, TXIDs, block explorer links, exchange KYC details

-

For card payments, instruct your issuer to raise a chargeback within 120 days of the transaction for most dispute types, cite ‘unauthorised transaction’ or ‘services not provided’ where applicable, attach the evidence packet, request case reference number for follow-up.

-

For bank transfers or e-wallets, contact the sending institution’s disputes unit immediately, ask for a recall request, provide timestamps plus beneficiary details, note that success probability falls sharply after settlement.

-

If cryptocurrency was used, accept that reversals are not possible via chain, forward TXIDs to the exchange used for fiat on/off ramps, ask that the receiving exchange freezes accounts linked to the suspicious address while law enforcement reviews the case.

-

Report suspected fraud to UK national authorities: submit a report to Action Fraud online, attach the evidence packet, obtain reference number for insurer claims or police follow-up; report the operator to the UK Gambling Commission when UK-targeting activity or adverts are present, include URLs, screenshots, timestamps.

-

If the payment provider refuses the chargeback, request a written final response within the provider’s specified timeframe, escalate to the Financial Ombudsman Service within six months using the final response letter plus the full evidence packet, keep all correspondence copies.

-

For recoveries under £10,000 in England and Wales, consider a small claims court claim using the bank’s final response plus the evidence packet, include details of attempts to resolve directly; seek regulated legal advice for larger sums.

-

Mitigation steps to implement immediately: cancel or block payment instruments used, cancel recurring authorisations, change account passwords, enable two-factor authentication, record future communications with timestamps.

Evidence checklist for submissions:

- Single PDF containing bank statement pages, transaction screenshot, merchant communications

- Separate folder with raw chat logs, email headers, support ticket exports

- Copies of any KYC documents provided to the operator, where privacy rules permit

- For crypto cases, CSV of wallet transactions plus block explorer permalinks

- Action Fraud reference number, bank dispute reference, operator complaint ID

Protecting your bankroll on mobile devices, public Wi‑Fi

Always enable a paid VPN with AES-256 encryption, a verified kill-switch, audited no-logs policy before accessing accounts or placing wagers.

Device hardening

Keep device firmware current: iOS 15+ or Google mobile OS 12+; apply security updates within 7 days of release. Disable developer options, refuse rooting or jailbreaking. Remove unused apps, limit background processes, install apps only from official stores.

Use a reputable password manager with 16+ character passphrases, unique credentials per account, automatic fill only after biometric confirmation. Prefer hardware 2FA tokens (U2F, FIDO2) or TOTP apps, avoid SMS one-time codes. Set app-specific PINs, enable session timeout at 5 minutes or less, enable device encryption.

Public Wi‑Fi measures

Avoid open Wi‑Fi for monetary transactions; use a personal tethered hotspot when possible. If public network use is unavoidable, verify the exact SSID with venue staff, forget the network after use, disable auto-join features, turn off file sharing.

Choose a VPN that supports WireGuard or OpenVPN, offers a kill-switch, publishes independent audit reports, provides AES-256 or ChaCha20 encryption. Enable DNS-over-HTTPS or set private DNS to Cloudflare (1.1.1.1) or Quad9 (9.9.9.9). Check site TLS certificates before entering credentials; prefer sites with HSTS and valid EV/OV where available.

Research wagering platforms via trusted resources such as betting sites not on gamstop, verify licencing details, read audit reports, confirm customer support response times.

| Risk |

Mitigation |

Action timeframe |

| Open public Wi‑Fi interception |

Use paid VPN with kill-switch, verify SSID, forget network after session |

Immediate |

| Compromised device (rooted, jailbroken) |

Restore factory image, avoid reinstalling risky apps, replace device if integrity cannot be proven |

Immediate |

| Weak credentials |

Password manager, unique 16+ character passphrases, hardware 2FA |

Within 24 hours |

| Unpatched vulnerabilities |

Apply OS updates within 7 days, enable automatic security patches |

Within 7 days |

| Untrusted DNS, spoofing |

Enable DNS-over-HTTPS, set private DNS to 1.1.1.1 or 9.9.9.9 |

Immediate |

Set deposit limits inside account settings where available, cap single-session spend to a fixed percentage of monthly disposable income, log out after every session, enable transaction alerts via email or push notifications.

Third‑party tools for responsible play: practical limits, blocks

Install a dedicated blocker app immediately, for example Gamban, BetBlocker, BlockSite; combine that with a bank-level merchant block to stop card payments to betting platforms.

Gamban blocks executable apps plus browser access across Windows, macOS, iOS, Android; activation is quick, uninstallation requires support intervention. BetBlocker is free, open-source, cross-platform, uses user-editable blocklists and schedules. Browser extensions such as BlockSite offer site-level restrictions with password protection; mobile app blockers add device-wide coverage.

Ask your bank to block merchant category codes (MCC) associated with wagering transactions, cancel recurring payments, or place a permanent gambling merchant block on a card. Digital banks (Monzo, Starling, Revolut) provide in-app spend controls and merchant-level toggles; use those controls to disable gambling spending immediately.

Set strict account limits on every platform you use: deposit cap, loss cap, wager cap, session-time cap. Choose short cooling-off periods first (24–72 hours) then medium-term blocks (1–6 months) for repeated breaches; select permanent exclusion where necessary. Record limit changes with screenshots or email confirmations so support teams can enforce them.

Reduce available funds using separate accounts or prepaid instruments: move a fixed weekly allowance to a specific card; use prepaid vouchers or a locked savings account for non-gambling expenses. Enable instant transaction alerts for any payment to betting merchants so you can spot breaches early.

Create external controls for accountability: give a trusted person emergency access via a password manager, set spending approvals through that person, use time‑locked password tools to delay access to gambling apps. If self-help fails, contact UK support services such as GamCare or GambleAware for assessment, referrals, evidence-based counselling.

Questions and Answers:

What does “Non-GamStop casino” mean and how is it different from sites on GamStop?

A Non-GamStop casino is an online operator that does not take part in the UK self-exclusion scheme known as GamStop. The main practical difference is that self-exclusion applied through GamStop covers only participating operators, so a person excluded via GamStop can still access sites that are not registered with the scheme. Many Non-GamStop sites hold licences from regulators outside the UK (for example Malta or Curacao), which can mean different consumer protections, verification procedures and dispute handling than those provided by UK-licensed operators. For anyone in the UK, it is important to be aware that protections such as strong complaint procedures, local dispute resolution and UK regulatory oversight may be reduced when using offshore platforms.

Are there legal risks for UK residents playing at Non-GamStop casinos?

Playing at offshore casinos is not automatically illegal for a UK resident, but the situation has trade-offs. UK gambling law primarily governs licensed operators that target UK customers; many consumer protections apply only when a site holds a UK Gambling Commission licence. Offshore sites may still accept UK players, yet you will likely have fewer legal remedies if a dispute arises. Financial institutions may also block some transactions, and terms in an operator’s terms and conditions can affect your rights. If you are unsure about the legal position or consequences, consider seeking independent legal or financial advice.

How can I check whether a Non-GamStop casino is reliable and safe to use?

Start with basic verification: locate the operator’s licence details and check the regulator’s site to confirm the licence is valid and matches the operator name. Look for SSL encryption on the site and public evidence of independent testing or audits (for example certificates from third-party testing labs). Read the terms and conditions closely, especially sections on bonuses, wagering requirements, identity checks and withdrawal rules. Search for recent player reviews and complaint threads on forums and watchdog sites; patterns of delayed withdrawals or account closures are warning signs. Test customer support responsiveness before depositing, and prefer operators that publish clear fairness and responsible-gambling policies. Finally, make a small initial deposit and request a withdrawal to verify processing speed and any hidden requirements.

What payment methods are safer to use at Non-GamStop casinos, and what should I watch for?

Reputable e-wallets (such as Skrill or Neteller), well-known card schemes and established bank transfers tend to offer better traceability and dispute options than lesser-known processors. Cryptocurrencies are available at some offshore sites; they offer privacy and fast payouts but provide limited chargeback options and can be volatile. Always check the casino’s KYC and withdrawal procedures up front—some sites require detailed documents and may hold funds while verifying identity. Watch for fees, minimum and maximum withdrawal limits, and unusually long payout windows. If you want stronger payment control, consider using a prepaid card or a separate e-wallet dedicated to gambling so you can isolate and monitor those transactions.

I’m trying to manage my gambling safely but have been excluded via GamStop. What responsible options exist if I still want to use Non-GamStop casinos?

If you are on GamStop because you want to restrict access, attempting to bypass that restriction risks undoing the protection you sought. Before using any Non-GamStop site, pause and consider support options such as contacting a counselling service or support group that specialises in gambling harm. There are practical steps to reduce risk without relying on offshore sites: ask your bank to block gambling transactions, use budgeting tools and time limits on devices, and install reputable site- and app-blockers that can be configured for specific categories. If you are determined to use an offshore operator despite exclusion, keep stakes low, set strict deposit and loss limits with a trusted person if possible, and choose only operators with clear, verifiable reputations. If gambling is causing harm, reach out to a professional support organisation rather than trying to find ways around self-exclusion.

Are non-GamStop casinos legal for UK players, and how can I verify a site’s trustworthiness?

GamStop is a voluntary UK self-exclusion scheme; being listed on it only affects access to participating sites. Some sites that accept UK customers operate under offshore licences (for example, MGA or Curaçao) and are not regulated by the UK Gambling Commission, which means they do not have the same UK customer protections. To check whether a site is reliable, look for a clearly displayed licence number and verify it on the regulator’s website, confirm the operator’s corporate details and physical address, check for SSL encryption on pages where you enter personal or financial data, and search for independent audit or certification reports (RNG, payout audits). Read recent player reports about deposits and withdrawals, test customer support responsiveness, and examine bonus terms and wagering requirements for unreasonable restrictions. If you need guaranteed UK-sector protections and self-exclusion coverage, choose UK Gambling Commission licensed sites; if you use non-GamStop options, apply stricter personal safeguards.

What practical safety measures should I take before depositing at a non-GamStop casino?

Start with verification steps: confirm the licence and check independent reviews and community feedback focused on withdrawal experiences. Read the site’s terms, especially rules on ID checks, withdrawal limits, and bonus wagering. Use payment methods that provide a record and some buyer protection — major debit/credit cards and reputable e-wallets are generally safer than unregulated payment routes; be cautious with crypto since transactions are usually irreversible and offer less formal recourse. Make a small initial deposit to test the site’s verification and cashout process. Choose sites that publish RTP figures and have independent testing lab seals. Protect your account with a strong, unique password and enable two-factor authentication if available. Keep digital copies of key pages (T&Cs, bonus rules, receipts) and monitor bank statements for unexpected charges. Set personal financial limits outside the site (bank card limits, app-based spending caps, or third-party blocking tools) so losses cannot exceed what you can afford. Be wary of offers that appear unusually generous; steep bonus conditions or blocked withdrawals after a win are common red flags. If gambling starts to feel harmful, seek support from UK help services such as GamCare or the National Gambling Helpline and consider professional advice. Finally, avoid sharing sensitive ID documents over unsecured email — use the site’s secure upload portal and confirm its privacy policy before sending anything.

.jpeg)

.jpeg)

.jpeg)

.jpeg)